To safeguard your economic future you must understand your financial investment alternatives. Person Retirement Accounts (Individual retirement accounts) stand as a popular option since they offer numerous kinds to aid satisfy your monetary preparation objectives. This evaluation covers both the distinct advantages and possible risks that feature adding precious metals to your IRA. The text includes a detailed overview for acquiring these properties and reviews vital factors to think about. Discover approaches to boost your retirement by adding precious metals to your investment portfolio. A Person Retirement Account (IRA) supplies retirement savings with tax obligation advantages enabling investors to allocate funds to various property classes such as supplies, bonds and tangible gold and silver. Self-directed Individual retirement accounts enable financiers to handle their profile options including special financial investments like silver and gold Individual retirement accounts.

Types of IRAs

Investors have access to several individual retirement Gold IRA Resource account options which deal with diverse retired life preparation demands. Investors can pick from Standard IRAs and Roth IRAs and also have actually specialized alternatives like Silver and gold IRAs that permit you to invest in physical steels such as silver and gold coins along with common funds and various other assets. Roth IRAs use tax-free retired life withdrawals which makes them advantageous for those that anticipate a higher tax brace in their retired life years. You can move funds from existing retirement accounts to a rollover IRA without any problems. The capability to purchase rare-earth element ETFs and IRA-approved steels together with realty and exclusive equity lets financiers attain various monetary objectives while maintaining compliance with guidelines and matching their threat resistance.Why Buy Precious Metals for IRA?

Your individual retirement account take advantage of buying precious metals with asset security enhancement as well as portfolio diversification while giving defense against market disturbances and inflationary stress which cause greater financial security amidst financial instability.Benefits and Risks

Precious metals Individual retirement accounts offer exclusive benefits that include feasible tax benefits and the ability to minimize market danger direct exposure. Financiers should meticulously assess liquidity, broker charges, and precious metals pricing to integrate these variables into their threat monitoring technique. People require to comprehend the tax obligation repercussions associated with precious metal transactions when they take place outdoors tax-advantaged accounts. Due diligence is essential when analyzing investment options in the precious metals market.How to Buy Precious Metals for IRA

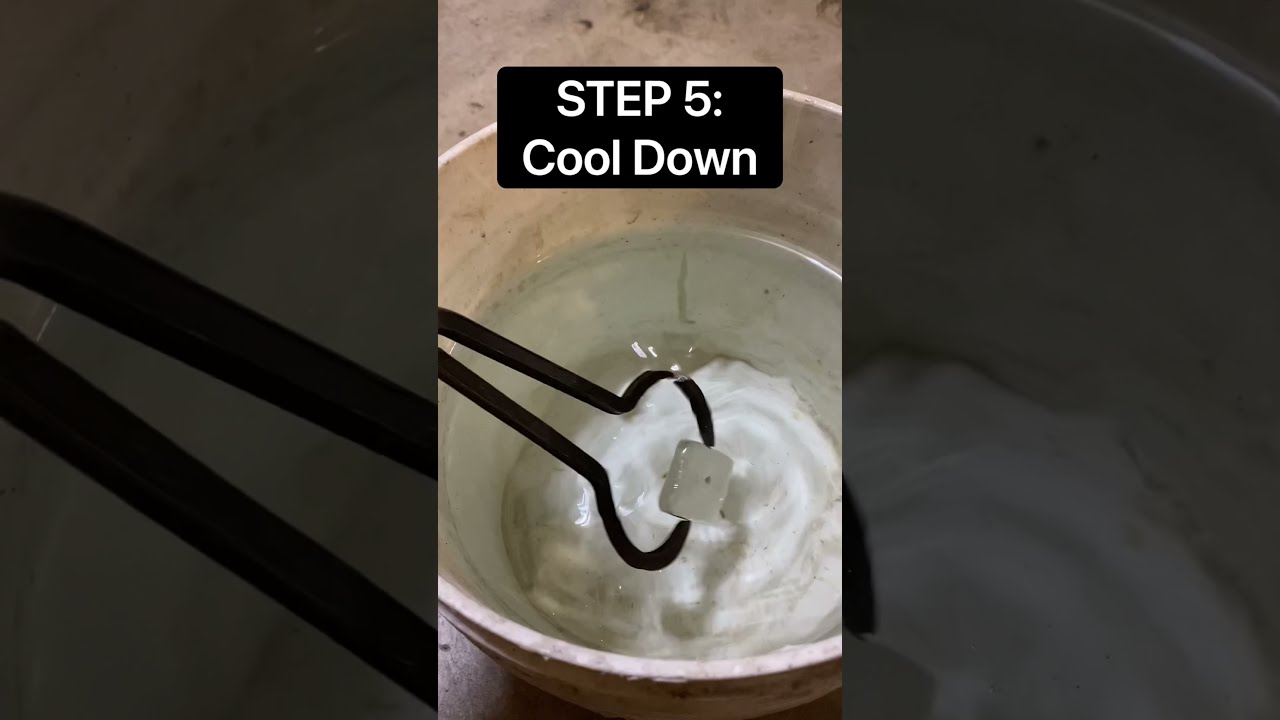

You need to stick to a structured purchase process to efficiently purchase precious metals for your IRA. Capitalists ought to select a trustworthy supplier and comprehend the acquisition overview while choosing appropriate precious metals storage options.Steps to Comply with and Important Considerations

To obtain precious metals for your individual retirement account one have to abide by vital steps. It is necessary to create an exact buying procedure while examining supplier high quality for assurance and selecting distribution techniques that match your monetary planning needs based upon financial investment timeframes and cash flow requirements.